Our "Whole Picture" Approach

At Perrier Ryan, we understand that each part of your life picture is crucial to the success of the overall financial strategy which is why we take a "whole picture" approach to our advice. Our financial planning focus is on your cash flow and how best to use that cash flow for you to grow your wealth, provide for your retirement and protect your family. Our priority is to ensure that your cash flow suits you and your family first so that you do not miss out on the pleasures of life that you deserve.

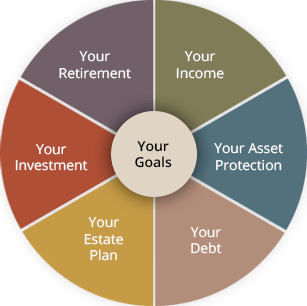

At Perrier Ryan, our objective is to help you achieve your goals, hence you will receive a full review of your personal, financial and retirement goals to ensure the strategies in your financial plan are really working for you.

Your goals and aspirations are at the centre your financial wellbeing. These goals could be about protecting your family, saving for your retirement, having better tax planning or budgeting, saving and investing to start wealth accumulation for your financially secure future. So that we have a full understanding of these goals we need to ensure all the parts of the picture are understood and work together for you to achieve your goals.

Things to think about ...

- What are your financial goals and are they realistic for your lifestyle and circumstances?

- How do you plan to achieve your financial goals?

- What do you need to change in order to achieve your goals?

- How do you find people to help you put strategies in place to help you reach your goals?

We all work hard for our income and the cost of living only seems to get higher as we move through the stages of our lives. Therefore, it is imperative that your income's effectiveness is maximised - meaning how can you use your income wisely to ensure that you have enough money to pay the bills, some money saved for a rainy day and some money invested for the future without impacting on your lifestyle requirements.

At Perrier Ryan, our role is to provide you with high quality, professional, reliable and consistent advice that will give you the support and the tools to ensure that your income is being used to the best of its ability.

Things to think about ...

- How do you maximise the effectiveness of your income?

- Do you have a budget?

- Are you saving regularly?

- What is your cashflow position?

We can't always assume that traumatic or tragic events will only happen to other people. But even if we accept life's realities, it is difficult to prepare for the emotional toll that a tragedy could take, never mind having financial stress with it. Fortunately, we can take action to minimise the otherwise devastating financial impact that serious illness or disablement can have on our lives, or that premature death could have on the lives of our families.

At Perrier Ryan, we can help you think about how to protect your assets, including your income which is the most valuable asset you have and needs protecting. We look at whether your financial assets are structured correctly to provide you the most benefit and whether they are adequately insured and protected against life's realities.

Things to think about ...

- Have you got insurance for your income in the event of illness, disablement or death?

- Are your assets protected in the case of accident or death?

- Are your assets structured correctly for tax purposes?

Most of us have some kind of debt to worry about in our lifetime, for some it is a car, a home or a business. Not all debt is "bad", however there are many things to consider when dealing with loans, for example:

- How is the loan structured?

- What is the loan being used for and could the conditions of the loan be improved?

- Does the loan, and its features, suit your needs and circumstances – now and into the future?

Our Financial Services division works with our financial advisors to help you not only avoid the debt "pitfalls" but also drive greater benefits from your lending. We can provide advice on all areas of lending, including home loans, commercial loans, vehicle and asset finance. With our services you can benefit from your own personal "bank manager" so that you don't have to spend your time dealing with the banks.

Things to think about ...

- What is your current level of debt and are you managing it?

- How is your debt structured and is it working effectively?

- Do you have a debt reduction strategy?

Estate planning is a way of ensuring that your assets are passed onto your beneficiaries not only correctly but also in the most financially efficient and tax effective way possible.

At Perrier Ryan we help you develop a successful estate plan by working with you throughout your lifetime to arrange your assets as your circumstances evolve. We concentrate on managing and preserving your wealth as well as ensuring that it is distributed according to your wishes and overall financial plan. We can also help you develop a carefully constructed Will and Power of Attorney to reduce the risk of having the right assets end up in the wrong hands. We can either facilitate this process with your solicitors or with one of our panel of solicitors who specialise in the estate planning area.

Things to think about ...

- Do you have a current and up-to-date Will or Power of Attorney?

- Have you considered strategies for your estate and the impact of transferring wealth to beneficiaries? Getting it to the right people at the right time

When it comes to investing, it's important to have a very clear understanding of what your specific aims or objectives are. Generally, the needs of an investment fall into one of the following categories:

- Achieve capital growth

- Provide an income

- A combination of both

At Perrier Ryan we provide a full review of your investments and help you to ensure that they are effectively getting you to your goals. We consider whether your investments are structured correctly to maximise their return to you in the timeframe that you need. We also work with you to help you to make decisions about your future investments to drive wealth accumulation with your resources, lifestyle and goals in mind. Our investment advice is focused on your cashflow requirements and ensuring that your money is placed in investments that are suitable for you.

Things to think about ...

- Do you understand your current investments including superannuation, investment portfolios and pension accounts?

- Are your investments growing in-line with projections and your expectations?

- Do your investments support your life goals, resources and circumstances?

When thinking about your retirement, thoughts inevitably focus on how you will support yourself financially in your retirement. Whilst most Australians of working age are members of a superannuation fund, "super" is not well understood and too often retirement planning falls to the wayside as life's day-to-day demands take up all of our time and energy.

At Perrier Ryan our role is to help you work out your retirement plan and your superannuation requirements so that you don't have to worry about it. We focus not only on setting up your retirement plan but also on ensuring that your superannuation is structured to provide you with benefits that suit your needs and circumstances.

Things to think about ...

- Do you have a retirement plan?

- How are you tracking towards your financial goals for retirement?

- Is your superannuation fund working for you?